Is XRP Facing Another Price Drop?

Recent analysis suggests that XRP may be heading for a significant price correction. A descending triangle pattern, a technical indicator often signaling bearish reversals, has appeared on the daily charts. This pattern, combined with declining open interest and negative funding rates, suggests a potential 41% drop to $1.18.

Understanding the Bearish Signals

Open interest fell from $5.53 billion on May 14 to $3.54 billion on June 23, indicating traders may be closing positions ahead of further declines. Historically, such trends make it difficult for assets to sustain upward momentum. Additionally, negative funding rates show increasing bets on lower prices.

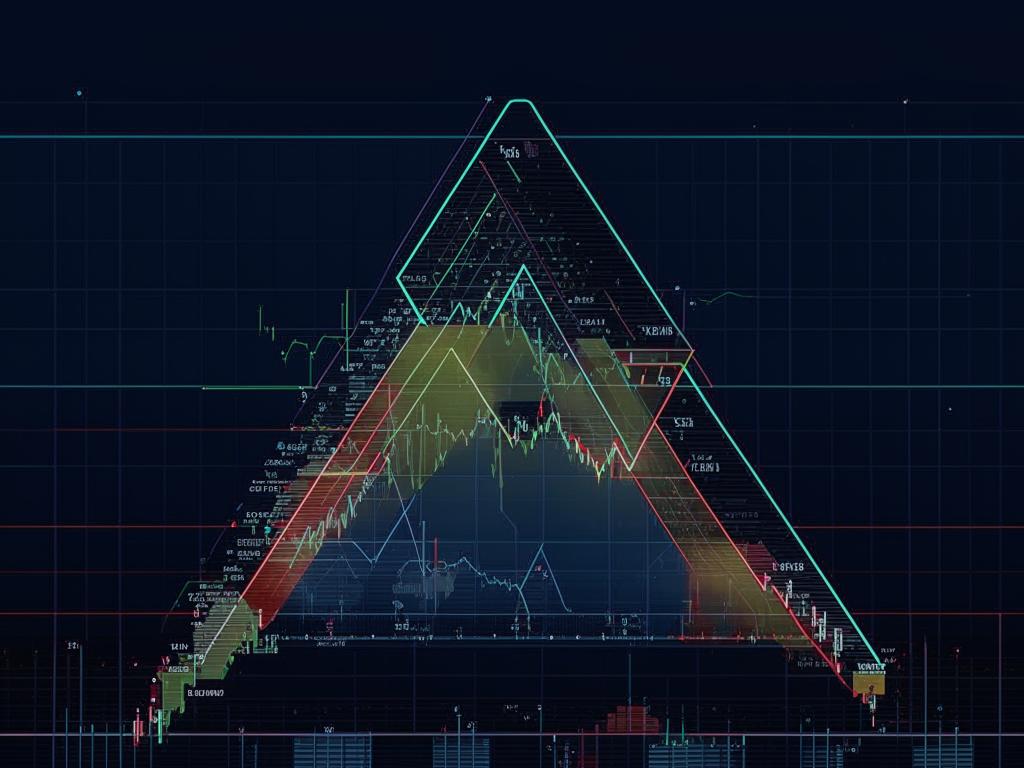

The Descending Triangle Pattern

Since late 2024, XRP has formed a descending triangle with flat support at $2.00 and downward-sloping resistance. A break below $2.00 could push prices to $1.18. Conversely, breaking resistance at $2.22 could invalidate the bearish outlook and target $3.00.

Key Liquidity Zones

The Binance XRP/USDT liquidation heatmap shows $1.75-$1.60 as a critical zone. Falling below $1.75 may trigger liquidations, potentially driving prices toward $1.60. These levels often influence price movements due to concentrated liquidity.

Final Thoughts

While current indicators appear bearish, cryptocurrency markets remain volatile. Traders should monitor these developments closely and conduct thorough research before making decisions. Understanding technical patterns and market signals can help navigate XRP’s price movements.