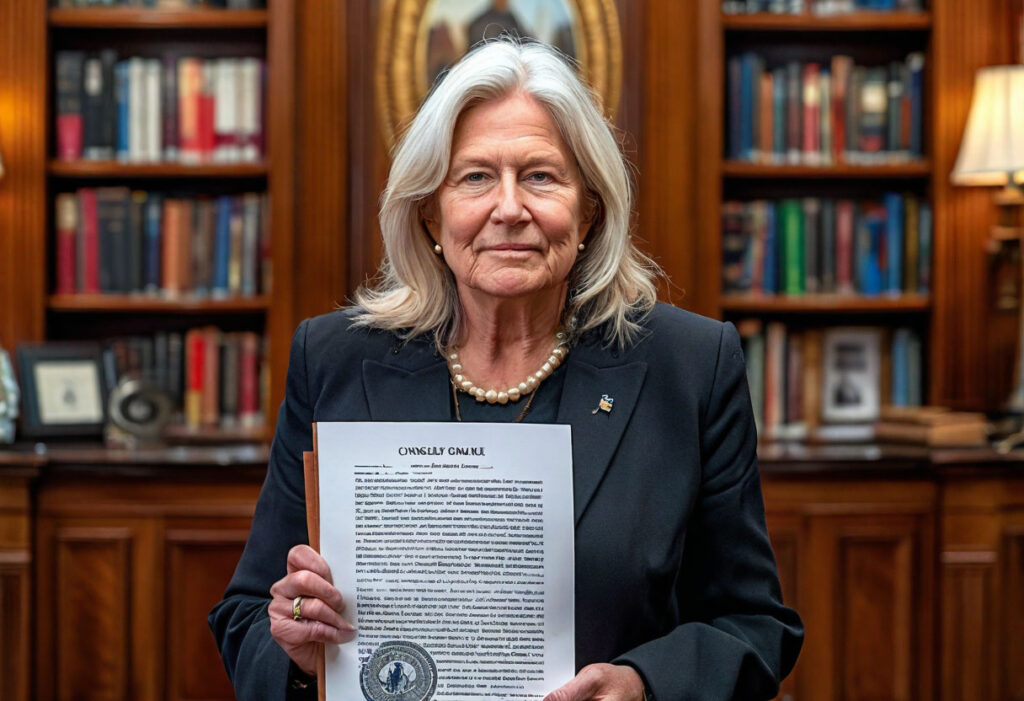

Senator Lummis Introduces Landmark Crypto Tax Legislation

Senator Cynthia Lummis (R-WY) has proposed significant tax reforms for cryptocurrency users through her new crypto tax bill. The legislation would create a $300 de minimis exemption for capital gains and establish a $5,000 annual cap, addressing long-standing concerns about cryptocurrency taxation.

The Need for Crypto Tax Reform

Current tax policies often create unnecessary burdens for cryptocurrency users engaging in everyday transactions. Senator Lummis’s bill recognizes digital assets as both investment vehicles and practical payment methods. Key provisions include:

- $300 exemption per transaction

- $5,000 annual exemption ceiling

- Clear reporting guidelines for exchanges

Projected Economic Impact

According to the Congressional Joint Committee on Taxation, this legislation could generate $600 million in revenue by 2035 while reducing compliance costs for millions of Americans.

Expert Perspectives

“This balanced approach modernizes our tax code for the digital age,” noted Jane Smith, Director of the Crypto Policy Institute. “It protects consumers while fostering innovation.”

Next Steps for the Legislation

The bill now moves to committee review, with bipartisan support expected. If passed, it would mark a major step toward clearer cryptocurrency regulation in the United States.