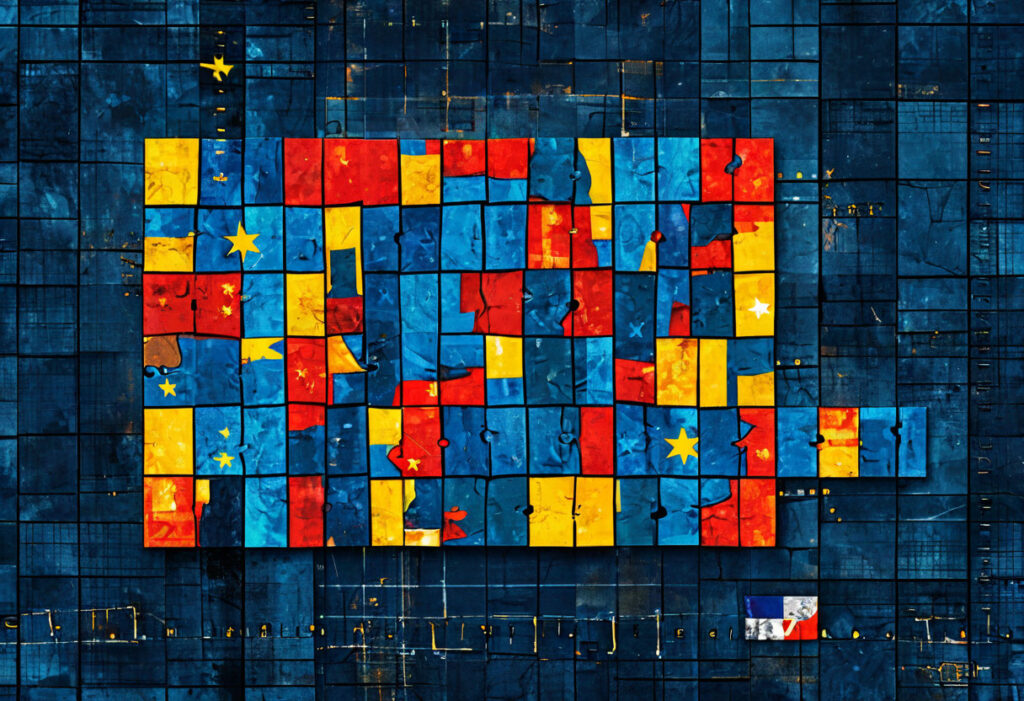

MiCA Regulation: Navigating the Fragmented EU Crypto Landscape

The Markets in Crypto-Assets Regulation (MiCA) seeks to standardize the European Union’s crypto market. According to Benedikt Faupel, Bitpanda‘s head of public affairs, the regulation’s uneven enforcement across member states presents significant challenges. While MiCA offers much-needed regulatory clarity, its implementation varies widely, leading to a fragmented market environment.

Current Challenges in MiCA Enforcement

Prior to MiCA, Europe’s crypto landscape was governed by up to 17 distinct licensing regimes. Today, the regulation’s interpretation differs among local regulators. Some jurisdictions mandate thorough pre-license examinations, while others adopt a more reactive approach. This inconsistency hinders the EU crypto market’s potential for uniform growth.

- Diverse licensing procedures across regions

- Absence of standardized enforcement measures

- Risk of regulatory arbitrage opportunities

Pathways to Greater Harmonization

Faupel acknowledges MiCA as a positive development but calls for refined reporting requirements to bridge disparities between nations. Bitpanda, holding three MiCA licenses, actively collaborates with EU policymakers to advocate for a more unified regulatory framework.

Prospects for Europe’s Crypto Sector

The growing institutional engagement, exemplified by Deutsche Bank’s upcoming crypto storage services in partnership with Bitpanda, reflects increasing confidence in the regulated EU crypto market.