Hive Digital Accelerates AI Pivot with $100M HPC Expansion

Hive Digital Technologies is strategically transitioning from Bitcoin mining to high-performance computing (HPC), aiming for a $100 million annual revenue run rate. The company is utilizing Nvidia’s H100 and upcoming Blackwell GPUs to fuel its growth in AI and HPC services. This shift comes as Bitcoin mining profitability declines following the 2024 halving event.

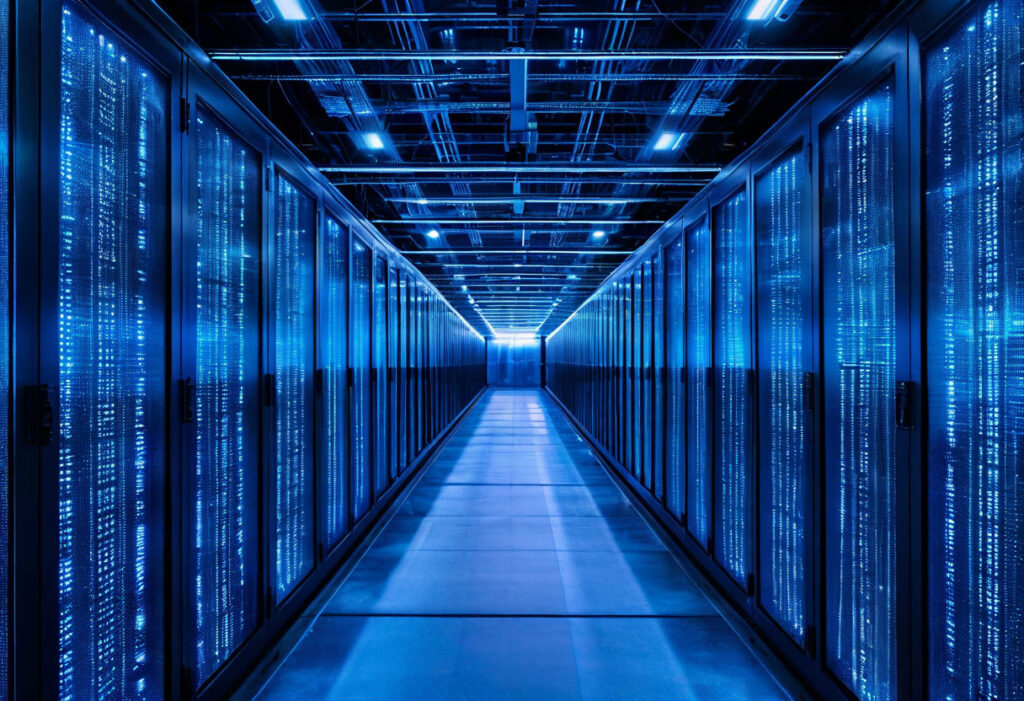

The Strategic Shift to HPC and AI

Originally starting with just 400 GPUs, Hive Digital has rapidly scaled its HPC operations to achieve a $20 million annual run rate. The company’s decision to pivot focuses on three key advantages:

- Greater profitability in AI computational services compared to Bitcoin mining

- Access to cutting-edge hardware like Nvidia’s latest AI chips

- Proximity to Toronto’s rich pool of AI talent and academic resources

Overcoming Expansion Challenges

CEO Aydin Kilic identifies electricity and land availability as primary challenges in scaling HPC operations. Hive Digital addresses these through:

- Strategic acquisition of a 7.2MW facility near Toronto Pearson Airport

- Integration into Canada’s thriving AI ecosystem and university networks

- Maintaining industry-leading energy efficiency of 17.5 J/TH in mining operations

Market Performance and Analyst Perspectives

Despite its strategic pivot, HIVE stock continues to mirror Bitcoin’s market movements. Financial analysts remain optimistic about its potential:

- H.C. Wainwright maintains a $10 price target

- Canaccord Genuity reiterates a $9 target

- The stock has shown a 31% recovery over the past month

Industry Trends: Crypto Miners Embracing AI

Hive Digital’s move reflects broader industry developments:

- CoreWeave’s landmark $9 billion acquisition of Core Scientific

- Multiple mining companies diversifying into AI services

- Market consolidation driven by post-halving economics