Norwegian Mining Firm Green Minerals AS Plans $1.2 Billion Bitcoin Purchase

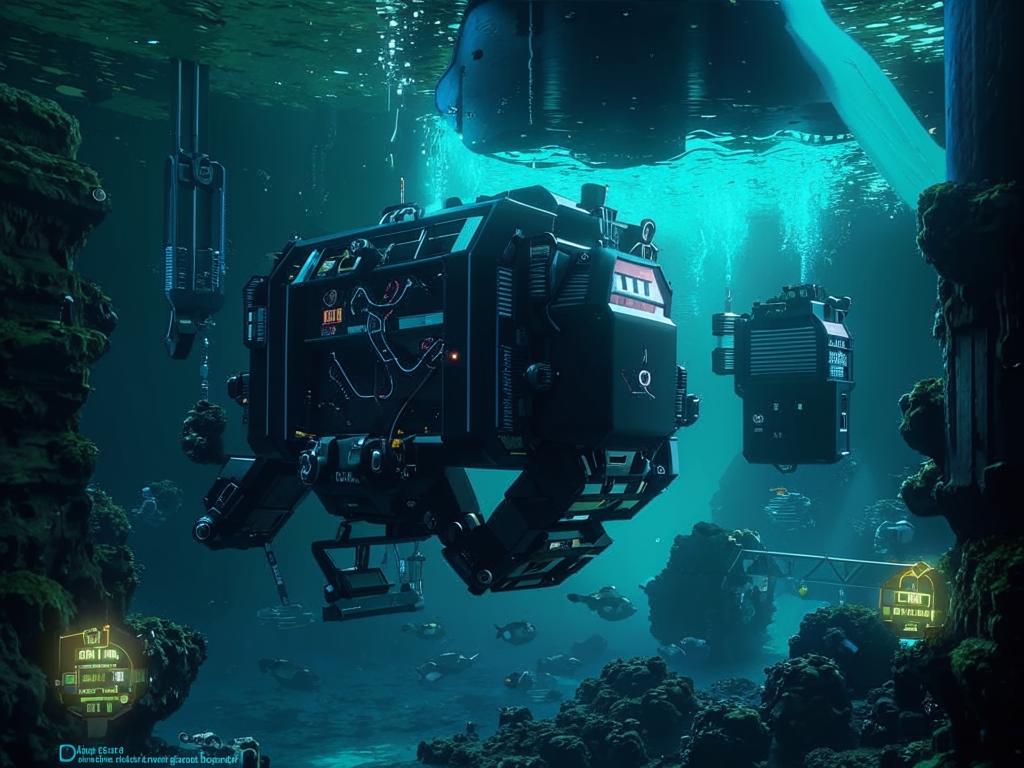

Green Minerals AS, a Norwegian deep-sea mining company, has announced plans to raise $1.2 billion to acquire Bitcoin. This strategic initiative aims to diversify the company’s assets beyond traditional fiat currencies while supporting future projects. Ståle Rodahl, the firm’s executive chair, highlighted Bitcoin‘s potential as a hedge against currency devaluation.

Strategic Bitcoin Treasury and Blockchain Integration

Beyond Bitcoin acquisition, Green Minerals will implement blockchain technology to enhance operational transparency and efficiency. The technology will help verify mineral origins and streamline supply chains, positioning the company as an industry leader in compliance and innovation.

Key Blockchain Applications

- Transparent supply chain tracking

- Authentic mineral certification

- Optimized operational workflows

Market Response and Industry Trends

The announcement triggered significant stock volatility, with shares initially surging 300% before dropping 34% the following day. This mirrors mixed market reactions to similar corporate Bitcoin purchases, where some companies see substantial gains while others experience minimal impact.

Future Outlook

Green Minerals will execute its first Bitcoin purchase within days and introduce a share-based performance metric to track Bitcoin value. This approach provides stakeholders with clear insights into the company’s cryptocurrency holdings.