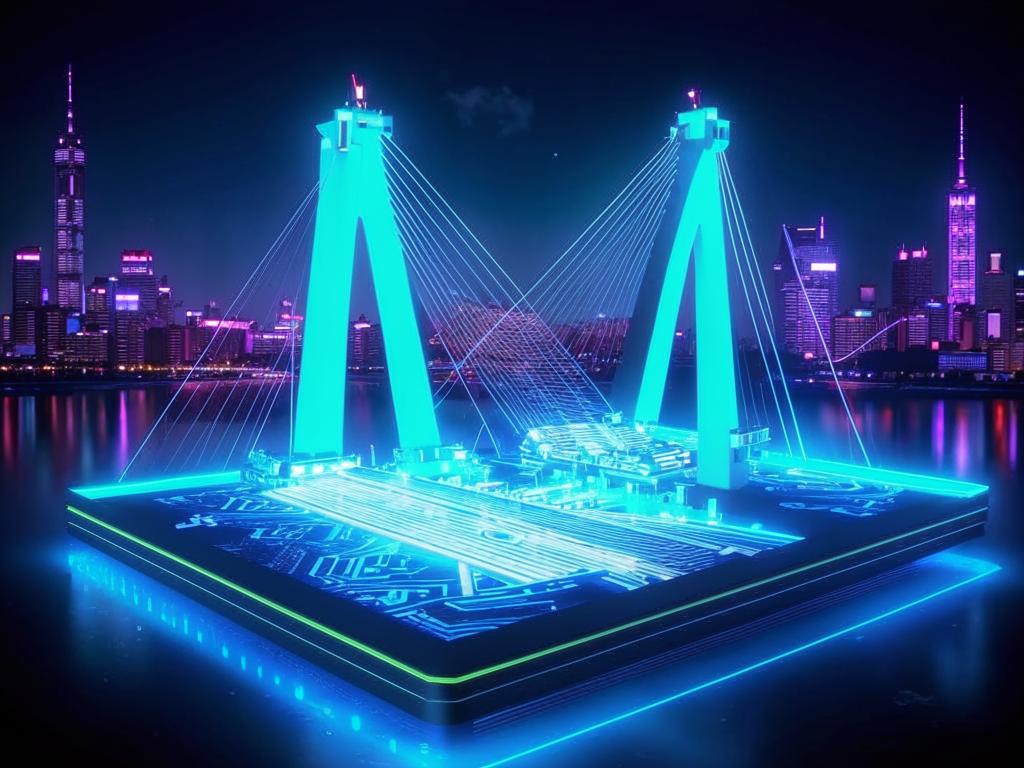

Flare Network Connects XRP to DeFi, Unlocking New Potential

The Flare Network is transforming decentralized finance (DeFi) by integrating XRP into its ecosystem. This development overcomes previous limitations of the XRP Ledger (XRPL), allowing XRP holders to participate in DeFi for the first time. Flare’s technology opens new avenues for liquidity and yield generation with XRP.

FAssets: Bridging XRP to DeFi

At the core of this integration is Flare’s FAssets system, which creates collateralized representations of non-smart contract assets. The system enables FXRP, a wrapped version of XRP that works seamlessly across DeFi protocols. This innovation significantly expands XRP’s utility in decentralized finance.

Institutional Adoption Gains Momentum

The XRPFi ecosystem is attracting attention from major players. Uphold, holding over 1.8 billion XRP, and publicly-traded VivoPower have committed substantial resources to this emerging DeFi space, validating Flare’s technological approach.

Liquid Staking Arrives with stXRP

Through the Firelight protocol, Flare introduces liquid staking for XRP via stXRP. This ERC-20 token represents staked FXRP and can be used across Flare’s growing DeFi landscape, enhancing XRP’s functionality as collateral and liquidity.

The Road Ahead for XRP in DeFi

With XRP’s $130 billion market capitalization, its integration through Flare Network could significantly impact DeFi liquidity. This development promises to bring more participants into decentralized finance while expanding XRP’s use cases beyond traditional payments.