Bitfarms Announces Strategic Share Buyback Amid Pivot to HPC and AI

Bitfarms, a global leader in Bitcoin mining, has launched a significant share repurchase program. The company plans to buy back up to 49.9 million shares, representing 10% of its public float, over the next 12 months. This move reflects confidence in the company’s valuation and its strategic transition toward high-performance computing (HPC) and AI infrastructure development.

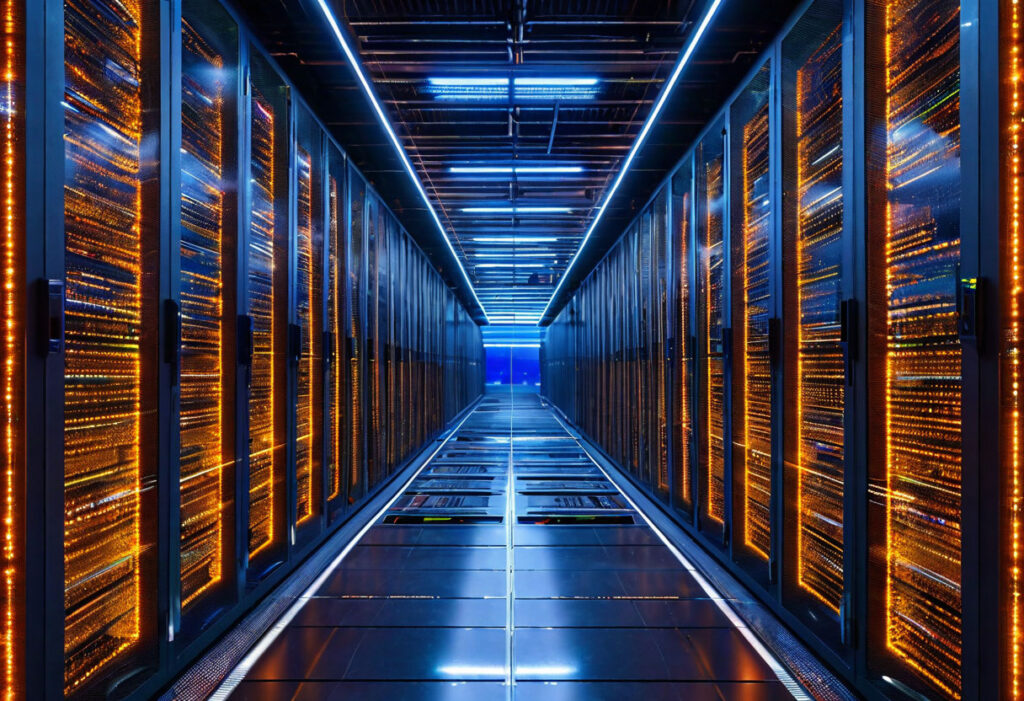

Transition to Next-Generation Computing

Approved by the Toronto Stock Exchange (TSX), the buyback program will run from July 2025 to July 2026 across both TSX and Nasdaq markets. All repurchased shares will be canceled, potentially increasing value for remaining shareholders. Ben Gagnon, CEO of Bitfarms, highlighted the company’s Pennsylvania energy assets as a key advantage in its expansion into AI applications.

Financial Restructuring and Growth Strategy

Despite reporting a $36 million net loss in Q1 2025, Bitfarms secured a $300 million credit facility from Macquarie to expand its HPC capabilities. The company also sold its Paraguay mining operation for $85 million, demonstrating its commitment to strategic realignment. This shift mirrors an industry-wide trend of Bitcoin miners diversifying into AI data centers following the 2024 Bitcoin halving’s impact on mining profitability.

Industry Evolution and Future Outlook

The move to HPC and AI allows Bitfarms to leverage its existing infrastructure, including specialized hardware and cooling systems. According to a March Coin Metrics report, this strategic repurposing of mining assets for AI data center hosting creates new revenue opportunities while maintaining operational efficiency.