Bitcoin Price Recovery: What’s Next?

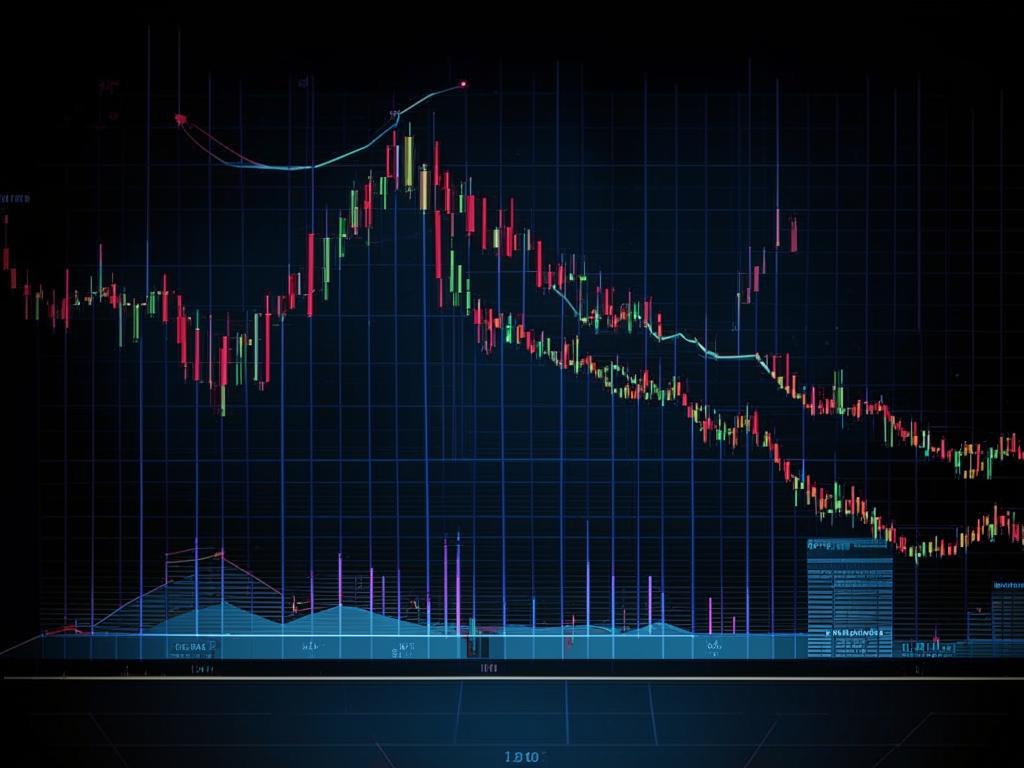

Bitcoin is showing signs of recovery, currently trading 6% below its all-time highs. Analysts see potential for further upside, with a key resistance level at $108,000 that could trigger a breakout. Despite a 10% rebound since June 5, reaching near-record highs at $110,800 on June 9, the likelihood of surpassing $120,000 before July remains low at 16%, according to Polymarket data.

Market Signals and On-Chain Data

On-chain data reveals a divergence between Bitcoin price and Binance open interest (OI), signaling market deleveraging. A significant liquidation cluster around $104,000 emerged on June 13 when long positions were closed. This event, combined with the Federal Reserve‘s decision to maintain interest rates, creates favorable conditions for Bitcoin, which historically performs well during periods of rate stability.

Expert Analysis

CryptoQuant analyst Amr Taha notes the market is undergoing a ‘cleansing of latecomers,’ coinciding with reduced open interest and liquidation exhaustion. Michael van de Poppe of MN Capital observes Bitcoin trending upward toward a crucial $108,000 resistance zone. A breakthrough could propel prices into uncharted territory.

Market Outlook

While indicators suggest the market is resetting, immediate new highs appear unlikely before July. The Bitcoin Short-Term Holder MVRV has normalized despite elevated prices, indicating a market recalibration. Analysts remain divided on near-term movements, with some predicting a potential surge above $120,000 this summer, though current probability stands at just 16%.