Bitcoin Price Dips Below $104K Ahead of ‘Triple Witching’ Options Expiration

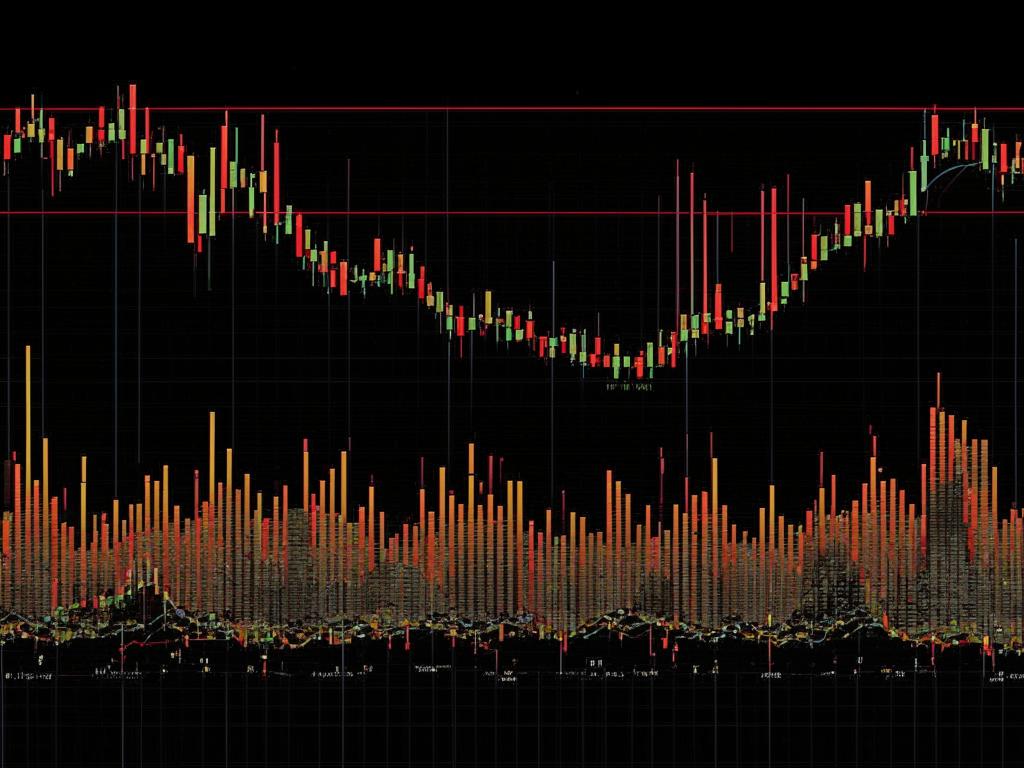

The Bitcoin price recently fell below $104,000 as it approached a ‘triple witching’ options expiry, a significant event in traditional finance markets. This event could increase volatility, but Bitcoin bulls are working to regain daily moving averages. Key support levels remain strong, potentially setting the stage for a rise to $135,000.

Market Dynamics and Analyst Insights

Analysts observe the market’s short positioning and notable ask depth on order books, signaling dominant spot flow. A record $6.8 trillion in options across various assets is set to expire, possibly marking the largest ‘triple witching’ event on record. This may trigger volatility for Bitcoin and other risk assets.

Long-Term Optimism Amid Current Fluctuations

Despite recent price declines, long-term optimism remains. A $135,000 BTC price target is still within reach, supported by technical analysis. Analysts point to a breakout from a right-angled descending broadening wedge as a positive indicator.

Key Facts

- Bitcoin price dropped below $104,000 ahead of a ‘triple witching’ options expiry.

- A record $6.8 trillion in options across various assets is set to expire.

- Bitcoin bulls are trying to reclaim daily moving averages.

- Key support levels hold for a potential rise to $135,000.

- Analysts stay optimistic about Bitcoin’s long-term price outlook.