Bitcoin Mining Output Declines in June Due to Power Restrictions

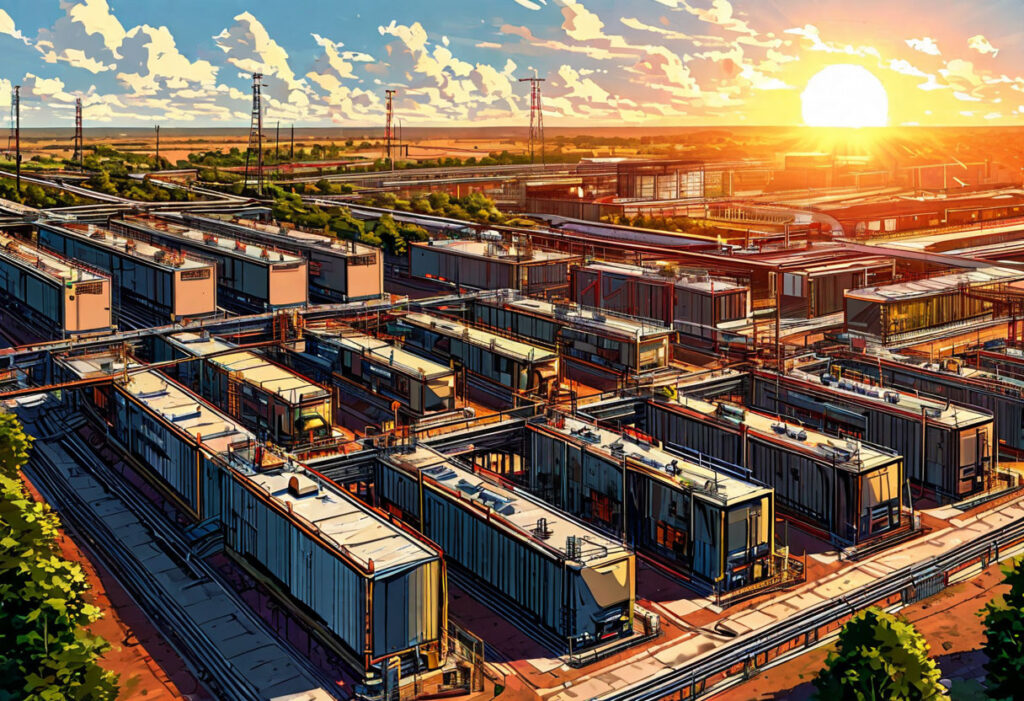

In June, Bitcoin mining firms reported a noticeable decrease in BTC production, primarily due to strategic power curtailment in Texas. This move aimed to avoid peak demand charges, balancing short-term production with operational costs.

Key Players and Their June Performance

Riot Platforms produced 450 BTC, a 12% drop from May. The company sold 397 BTC for $41.7 million and currently holds 19,273 Bitcoin. Jason Les, Riot’s CEO, emphasized their participation in ERCOT’s 4CP program to enhance grid stability and maintain competitive advantage.

- Cipher Mining reported producing 160 BTC, selling 58, and holding 1,063 Bitcoin.

- MARA Holdings experienced a 25% production drop, mining 211 BTC while holding 49,940 BTC.

- CleanSpark increased output by 6.7%, mining 445 BTC and holding 6,591 Bitcoin.

Understanding the Impact of ERCOT’s 4CP Program

The 4CP program helps manage peak electricity demand during summer months. By voluntarily reducing operations, Bitcoin miners avoid high transmission charges, contributing to grid stability while optimizing costs.

Expert Insights

“Strategic curtailment demonstrates the industry’s ability to adapt to external challenges,” noted a cryptocurrency mining analyst. This approach effectively balances operational expenses with production objectives.

Conclusion

June’s Bitcoin mining trends highlight the sector’s resilience. While some firms adjusted to power and weather challenges, others like CleanSpark achieved growth. This adaptability underscores the dynamic nature of cryptocurrency mining operations.